In a hangar at the University of Edinburgh, a triangular steel contraption sits beside a giant tank of water. Inside the tank, a technician in a yellow dinghy adjusts equipment so that the triangled structure can be hoisted into the water to see how it deals with simulated waves and currents. One day soon, a platform 50 times as large may float in the deep waters of the North Sea, buoying up a massive wind turbine to harvest the steady, strong breezes there. About an hour’s ride up the coast, full-scale 3,000-tonne behemoths already float in Aberdeen Bay, capturing enough wind energy to electrify nearly 35,000 Scottish households.

The prototype at the FloWave facility—one of 10 new floating wind-power designs being tested here—is progressing fast, says Tom Davey, who oversees testing. “Everything you see here has been manufactured and put in the water in the last couple months.”

There’s good reason for this hustle: The United Kingdom wants to add 34 gigawatts of offshore wind power by 2030, en route to decarbonizing its grid by 2035. But the shallow waters east of London are already packed with wind turbines. Scotland’s deeper waters are therefore the U.K.’s next frontier. Auctions have set aside parcels for 27 floating wind farms, with a combined capacity exceeding 24 GW.

This scale model of a floating wind-turbine platform is one of 10 new designs being tested at the University of Edinburgh’s FloWave facility.Peter Fairley

This scale model of a floating wind-turbine platform is one of 10 new designs being tested at the University of Edinburgh’s FloWave facility.Peter Fairley

This rush to deep water is a global phenomenon. To arrest the accelerating pace of a changing climate, the world needs a lot more clean energy to electrify heating, transportation, and industry and to displace fossil-fuel generation. Offshore wind power is already playing a key role in this transition. But the steadiest, strongest wind blows over deep water—well beyond the 60- to 70-meter limit for the fixed foundations that anchor traditional wind turbines to the ocean floor. And in many places, such as North America’s deep Pacific coast, the strongest and steadiest wind blows in the evening, which would perfectly complement solar energy’s daytime peaks.

Hence the push for wind platforms that float. The Biden administration has called for 15 GW of floating offshore wind capacity in the United States by 2035, and recent research suggests that the U.S. Pacific coast could support 100 GW more by midcentury. Ireland, South Korea, and Taiwan are among the other countries with bold floating wind ambitions.

The question is how to scale up the technology to gigawatt scale. This global debate is pitting innovation against risk.

On the innovation end are people like Davey and the FloWave team, who’ve already advanced several floating wind devices to sea trials. One FloWave-tested platform, engineered by Copenhagen-based Stiesdal Offshore, was recently selected for a 100-megawatt wind farm to be built off Scotland’s northern tip in 2025.

Kincardine Offshore Wind Farm project Principle Power

Established tech companies, however, argue that their more conservative designs are ready to go today, and at bigger scale. What the industry really needs to drive down costs, they say, is economies of scale. “In our view, this is purely a deployment question,” says Aaron Smith, chief commercial officer for the floating wind-tech developer Principle Power, based in Emeryville, Calif., whose platforms support the 190-meter-high, 9.5-MW turbines operating in Aberdeen Bay.

If governments provide consistent, long-term subsidies, industry standardization and mass production will deliver the gigawatts, Smith says. “We have the technology. We’re just angling for the right market conditions to deploy that at scale.”

What are the advantages of floating wind power?

To fully understand what developers are up against, it helps to know how hard it is to deploy any kind of wind power at sea. The 15-MW turbines being ordered today for tomorrow’s offshore wind farms weigh roughly 1,000 tonnes. The foundations of traditional offshore wind turbines are also massive steel or concrete structures that have to be embedded in the ocean floor. And installing a turbine atop a tower that’s twice as tall as the Statue of Liberty requires dedicated and costly vessels, which are in short supply worldwide.

You can do without such vessels by using a floating platform. The equipment can be fully assembled on shore and then towed to the site. But having a platform that floats compounds the challenge of supporting the towering turbine.

To stabilize the first floating wind farm, completed in 2017 about 50 kilometers northeast of the Aberdeen project, Norwegian energy giant Equinor used a steel column that extends 78 meters into the water. This dense mass, called a spar platform, works like the keel of a boat. Equinor used the same design for an 88-MW, 11-turbine array—the world’s largest, though probably not for long—completed this year in Norway. At that project, cables transfer the electricity to oil and gas platforms, rather than delivering the power back to shore.

Equinor constructed floating wind farms in Scotland and Norway. The turbines and platforms can be assembled on shore and then towed out to sea.Jan Arne Wold/Woldcam/Equinor

Equinor constructed floating wind farms in Scotland and Norway. The turbines and platforms can be assembled on shore and then towed out to sea.Jan Arne Wold/Woldcam/Equinor

Ole Jørgen Bratland/Equinor

Ole Jørgen Bratland/Equinor

For its next floating wind projects, Equinor plans to use the more conservative semisubmersible design, a technology perfected for oil and gas platforms. Semisubmersibles don’t go deep the way spar platforms do; instead, they achieve stability by extending their buoyancy horizontally. Principle Power’s WindFloat is a three-sided semisubmersible platform that is roughly 70 meters on a side. A concrete square variant from France’s BW Ideol is 35 to 55 meters on a side.

Chains and anchors in the seabed prevent these platforms from spinning or drifting, which is crucial for minimizing the movements that would flex and fatigue the turbines’ power cables. Some platforms, such as WindFloat, shift ballast around to dampen wave action or to keep the rotor perpendicular to the wind so as to maximize energy capture. WindFloat moves the water ballast with pumps that run for about 20 minutes a day. “You’re naturally going to be heeling out of the wind, just like with a sailboat. We’re shifting the water balance to compensate,” explains Smith.

Principle Power then marries conventional wind turbines to the company’s floating platforms, making small but vital tweaks to the turbine’s control system to compensate for the differences between fixed and floating conditions. For example, if a floating platform starts to tip due to strong waves, a control system designed for a fixed foundation may interpret the movement as a change in wind speed and then pitch the blades in response. That correction could instead amplify the rocking motion. WindFloat’s turbine controls are tuned to prevent such dangerous feedback.

Until four or five years ago, floating wind developers had to sort out such issues on their own, because most turbine manufacturers weren’t interested in working with them. But now that developers are shopping for dozens of turbines for gigawatt-scale floating projects, turbine manufacturers are finally devoting engineering resources to the cause.

Thomas Choisnet, until recently chief technology officer of BW Ideol, says the current generation of 15-MW turbines developed for fixed-foundation wind farms also have specifications for floating. “They are making sure that everything works in this moving environment,” he says. Floating projects thus benefit from the decades of design optimization and manufacturing scale that went into building today’s conventional offshore wind installations.

Conventional approaches take the lead

Beyond the technological advantages of using a tried-and-true approach, there’s a financial upside, Smith says. Floating wind developers must convince risk-averse bankers and insurers to back their projects, and it helps to be able to point to your project’s use of established technology. In years past, offshore wind investors who backed innovative but flawed designs suffered huge losses.

Gigawatt-scale offshore installations also require massive public and private investments in ports and supply chains. Consider the 960-MW Buchan wind farm that Ideol is developing for the Scottish North Sea. Because the project includes a seasoned technology provider, it is moving faster than most. The consortium has already secured connections to the grid, and Ideol has secured 34 hectares east of Inverness to manufacture its platforms.

The owners of the mothballed Ardersier Port, which once serviced oil and gas platforms, plan to work with Ideol to transform the port into a regional hub that will deliver floating wind platforms to projects across the North Sea. To produce the steel-reinforced concrete for Ideol’s platforms, Ardersier will get a new concrete plant, an oil-rig decommissioning facility, and the U.K.’s first new steelworks in half a century, to recycle the rigs’ steel. The steel mill, says Ideol, will be one of the world’s first to replace metallurgical coal with renewable electricity and hydrogen.

Building superstable platforms like Ideol’s and Principle Power’s to accommodate conventional turbines is expensive. According to the consulting firm BloombergNEF, recent floating projects cost up to US $10 million per megawatt. The resulting power is roughly three times as expensive as generation from fixed-bottom offshore wind. And those high costs are hindering developers’ ability to clinch long-term power-supply contracts with utilities. In June, energy consultancy 4C Offshore cut its global floating wind-power projection for 2030 by nearly a quarter compared with its projection from a year earlier.

France’s BW Ideol uses a square of concrete for its floating platform [left and at top]. Like Principle Power’s steel triangular platform [right], its horizontal lines extend its buoyancy, keeping it stable.Left: V. Joncheray/BW Ideol; Right: Principle Power

France’s BW Ideol uses a square of concrete for its floating platform [left and at top]. Like Principle Power’s steel triangular platform [right], its horizontal lines extend its buoyancy, keeping it stable.Left: V. Joncheray/BW Ideol; Right: Principle Power

At the Floating Offshore Wind Turbines conference held last May, several developers called on leading turbine manufacturers, such as Vestas and General Electric, to adapt their hardware to help reduce the cost of floating wind. For example, if turbines could deal with more motion, then floating platforms could be smaller, and thus less expensive, says Cédric Le Bousse, director for marine renewable energy for the French utility Électricité de France, which recently installed a three-turbine floating wind demonstration near Marseille. As it is, he says, floating platforms must be “over-dimensioned” to achieve the strict limits on movements set by the turbine manufacturers.

The promise of new designs

Meanwhile, floating wind’s mold-breakers are offering an ever-expanding diversity of technology options. At least 80 designs for platforms or integrated platform-turbines now vie for the floating wind market.

For starters, there are dozens of platform designs. There are semisubmersibles that seat the turbine toward the center of the structure, such as Stiesdal’s tetrahedral TetraSub. That geometry distributes the rotor’s weight and torquing forces and reduces the platform’s weight and thus its cost. There’s a 40,000-tonne spar platform that replaces the steel column with a cheaper, 285-meter-long column of concrete.

More radical floating wind-power designs flout decades-old engineering assumptions. Many of these assumptions make less sense far offshore, says Klaus Ulrich Drechsel, an offshore-energy engineering manager for the German utility EnBW. “It’s important to not only try to overcome the disadvantages but also to take advantage of the potential benefits of floating.”

Myriad Wind Energy Systems describes its 12-rotor wind turbine as a “wind farm on a stick.”Myriad Wind Energy Systems

Myriad Wind Energy Systems describes its 12-rotor wind turbine as a “wind farm on a stick.”Myriad Wind Energy Systems

For example, some floating turbine configurations allow the rotor to face downwind. Turbine makers had long avoided doing that because it’s noisy, as the blades must pass through the wind’s “shadow” behind the tower. But far offshore, the resulting thump-thump-thump is unlikely to offend anyone. And the wind itself can then orient the rotor, eliminating the need for motors and gears that keep conventional turbines facing into the wind.

Another idea is to add more rotors to a single tower. Multirotor turbines can enhance production by forcing more air to flow through the rotors. The rotors’ counterrotation, meanwhile, neutralizes the torquing force that tilts single-rotor floaters to one side and strains turbine towers.

Big corporate players are taking up the multirotor and downwind designs. Plenitude, a subsidiary of the Italian oil and gas producer Eni, has bought into EnerOcean, a Spanish firm that validated its 12-MW twin-rotor design at FloWave. Chinese turbine giant Mingyang Smart Energy Group is manufacturing a floater with dual 8.3-MW rotors, set for installation this year off Macau. EnBW is cofunding that demonstration, in exchange for exclusive rights to deploy the design in Europe.

The trio of industrial Ph.D.s behind Scottish startup Myriad Wind Energy Systems figure two rotors can’t capture the full benefits of multiple rotors. Their 90-meter-tall array has 12 rotors. “We’re seeing it as kind of a ‘wind farm on a stick,’” says Paul Pirrie, Myriad’s CTO.

Myriad uses a pivoting tree structure to support the rotors. The frame is modular for easier transport. Integrated tracks and lifts facilitate assembly, with the turbine generators and rotors delivered to the base and raised into place. Any faulty equipment, which otherwise would be a logistical nightmare to repair or replace out at sea, can return to the tower’s bottom via the tracks and lifts, with the replacement part hoisted aloft via the same route.

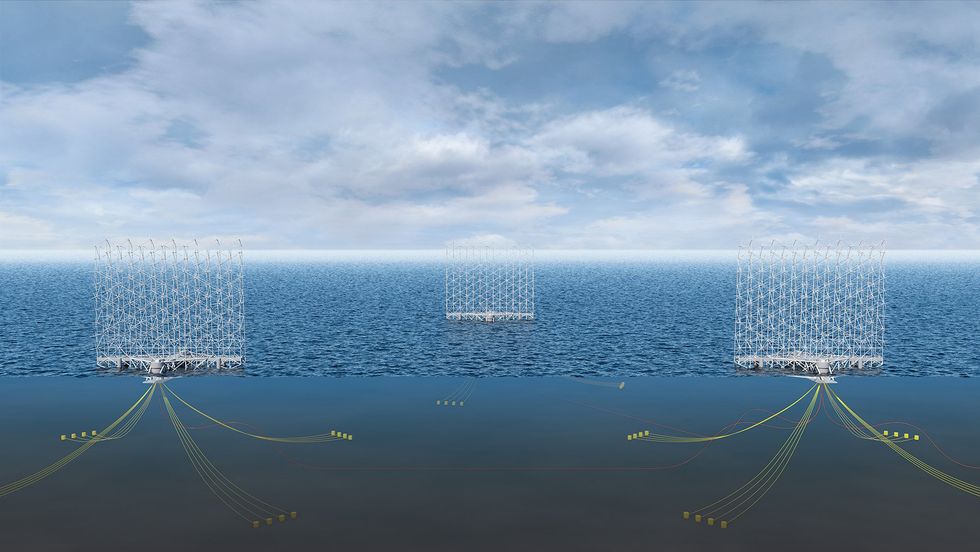

Myriad hopes to have a demonstrator installed on land in 2025. But the company is already facing competition from Oslo startup Wind Catching Systems, whose 126-rotor floating design is in prototype development with help from General Motors.

Wind Catching Systems’s 126-rotor design would be tethered to the ocean floor. Some floating wind designs call for a completely tetherless platform.Wind Catching Systems

Wind Catching Systems’s 126-rotor design would be tethered to the ocean floor. Some floating wind designs call for a completely tetherless platform.Wind Catching Systems

Sustained government support is key

Ultimately, floating wind power could become completely untethered. Several teams worldwide are now working on wind ships, a concept first suggested by the U.S. wind-energy pioneer William Heronemus in 1972. He envisioned a tetherless, self-propelled floating platform that would capture wind power, use it to generate hydrogen, and store that fuel for delivery to shore. (Heronemus also launched the University of Massachusetts’ wind-engineering program, training the engineers who launched the U.S. wind-power industry.)

Autonomous wind ships cut out the power cables and mooring chains used by floating offshore wind platforms. Concepts like the UMass team’s Wind Trawler, a modern version of Heronemus’s wind ship, “are not depth limited at all and so have a potentially enormous capture area,” says James Manwell, an engineering professor at UMass Amherst.

Eliminating power cables and mooring chains could also assuage some of the concerns over offshore wind’s potential effect on fisheries and wildlife. For example, fishing is generally banned within wind farms to avoid entanglement of fishing gear. Such fishing-free zones tend to enhance fisheries, providing a refuge in which fish grow larger and reproduce. Nevertheless, fishing interests often oppose any limits to their freedom to fish, arguing that restricted areas force them to travel further. Citing such concerns, Oregon’s governor recently called for a pause in offshore wind preparations, even though turbines floating off the Pacific coast are still years away.

In the near term, the floating wind industry faces a more intrinsic, logistical problem. Namely, developers need ports to start gearing up to build and launch their massive wind machines. Scottish Renewables, a regional industry group, says that the U.K. “urgently” needs to transform at least three ports into industrial hubs in order for the country to meet its 2030 energy and emissions goals. And yet the industry hasn’t settled on which turbine and platform designs are best, and so ports do not know how to gear up.

Iain Sinclair [left] and Rory Gunn are with the Global Energy Group, which is transforming Scotland’s Port of Nigg into a wind-power hub. Peter Fairley

Iain Sinclair [left] and Rory Gunn are with the Global Energy Group, which is transforming Scotland’s Port of Nigg into a wind-power hub. Peter Fairley

“The variables make for an absolute minefield,” says Iain Sinclair, executive director for renewables and energy transition for the Edinburgh-based Global Energy Group. Sinclair’s company owns three Scottish ports, including the Port of Nigg northeast of Inverness, which has been identified as one of the most promising places for floating wind power.

Back in the day, Nigg built about 40 percent of the North Sea’s oil and gas platforms. At the port’s peak in the 1970s and 1980s, 4,000 people worked there, and petroleum fumes filled the air. Today, you’re more likely to smell distillery vapors wafting over the harbor—what locals call the “angels’ share” of the Highland’s popular single malts. Nigg’s oil terminal is shuttered, and drilling platforms visit infrequently. But there’s plenty of bustle now, thanks to investments by Global Energy Group that have turned Nigg into a staging point for offshore wind construction. When IEEE Spectrum visited, cranes were lifting enormous towers, nacelles, and blades onto an installation vessel, destined for a fixed-foundation wind farm.

Sinclair is betting that building, deploying, and maintaining floating wind farms will ultimately dwarf the last century’s oil and gas boom. And it could happen fast: An independent 2021 report predicted that floating offshore wind would contribute £1.5-billion to Scotland’s economy by 2027 with only modest port upgrades, and up to triple that amount with more strategic investments.

To determine where to focus Nigg’s upgrades, Sinclair and his team have assessed 57 floating wind designs and zeroed in on a half-dozen of the most promising. They’ve mapped those designs onto Nigg’s existing and potential capabilities, such as manufacturing tubular steel, assembling components in the port’s 36,000 square meters of covered fabrication space, and pairing turbines to platforms along the harbor’s 1.2-km-long quayside.

What the floating wind industry really needs now, says Sinclair, is sustained government support. At Nigg, that means more than the U.K. government’s £160 million for floating offshore wind manufacturing announced in March, which Scottish Renewables says “falls woefully short.” It also means a plan to develop Scotland’s ports, which could cost £4 billion. The same concerns are being voiced by floating wind proponents in the United States, France, Germany, and other countries, as they push for their own infrastructure upgrades.

Henry Jeffrey, one of Tom Davey’s colleagues at the University of Edinburgh, is a transplant from offshore oil and gas engineering who now codirects the U.K.’s Supergen Offshore Renewable Energy R&D effort. He agrees that governments need to step up. Jeffrey says politicians ask him all the time when floating offshore wind technology will be competitive.

“I say, ‘Well, it’s directly proportional to your political will. It’s up to you to make it happen,’” Jeffrey says. The technology is “as close and credible as government wants it to be.”

Reference: https://ift.tt/yf0QnVz

No comments:

Post a Comment