The days are numbered for the Lerwick Power Station, whose diesel generators have supplied electricity to the Shetland Islands for over 70 years. Starting around the middle of 2024, the Shetlands—and also part of mainland Scotland—will be powered by the 443-megawatt Viking wind farm, consisting of 103 wind turbines on the main island of Shetland.

But what’s most interesting about the mammoth, £580 million project isn’t so much the turbines as the subsea transmission link that will connect the wind farm to the Scottish mainland. Peak demand in the Shetlands is only about 44 MW, so at any given time as much as 90 percent of the Viking output could flow south via the link. The 260-kilometer, 320-kilovolt high-voltage direct-current (HVDC) transmission system, based on technology from Hitachi Energy, in Zurich, marks a milestone in an ongoing transformation of the European power grid: It will plug into the first truly dynamic multiterminal HVDC network in Europe.

This newer HVDC technology is opening up new opportunities. “European grid operators are adopting HVDC as the technology of choice for their bulk-transmission needs in the future,” says Cornelis Plet, vice president for DNV, a consultancy that advises on power systems and risk management.

According to Plet, wind energy is driving an acceleration of HVDC installations in Europe. By 2030, the European Union seeks to roughly double, to 42.5 percent, the share of energy met by renewables. Officials are prioritizing projects that tap the relatively consistent and strong winds that blow farther offshore, more than 75 km, say—a distance for which the high capacitance of insulated power cables renders AC transmission impractical. Grid operators are also installing subsea DC interconnections in other regions to share wind-energy surpluses and connect to backup supplies, such as Scandinavia’s giant hydropower reservoirs. Furthermore, subsea and underground HVDC cables increasingly look like the most viable way to push added wind power across congested national grids and densely populated landscapes.

New Technology Drives an HVDC Renaissance

Driving this expansion in HVDC are major technical advances. Historically, HVDC lines conveyed power from one single point to another. The level of power transfer needed to be set, and its direction could not be instantaneously reversed—as would be necessary if the lines were part of a network. However, starting around 25 years ago, the path to multiterminal HVDC systems was established by big improvements in the converters that change high-voltage alternating current to DC, and vice versa.

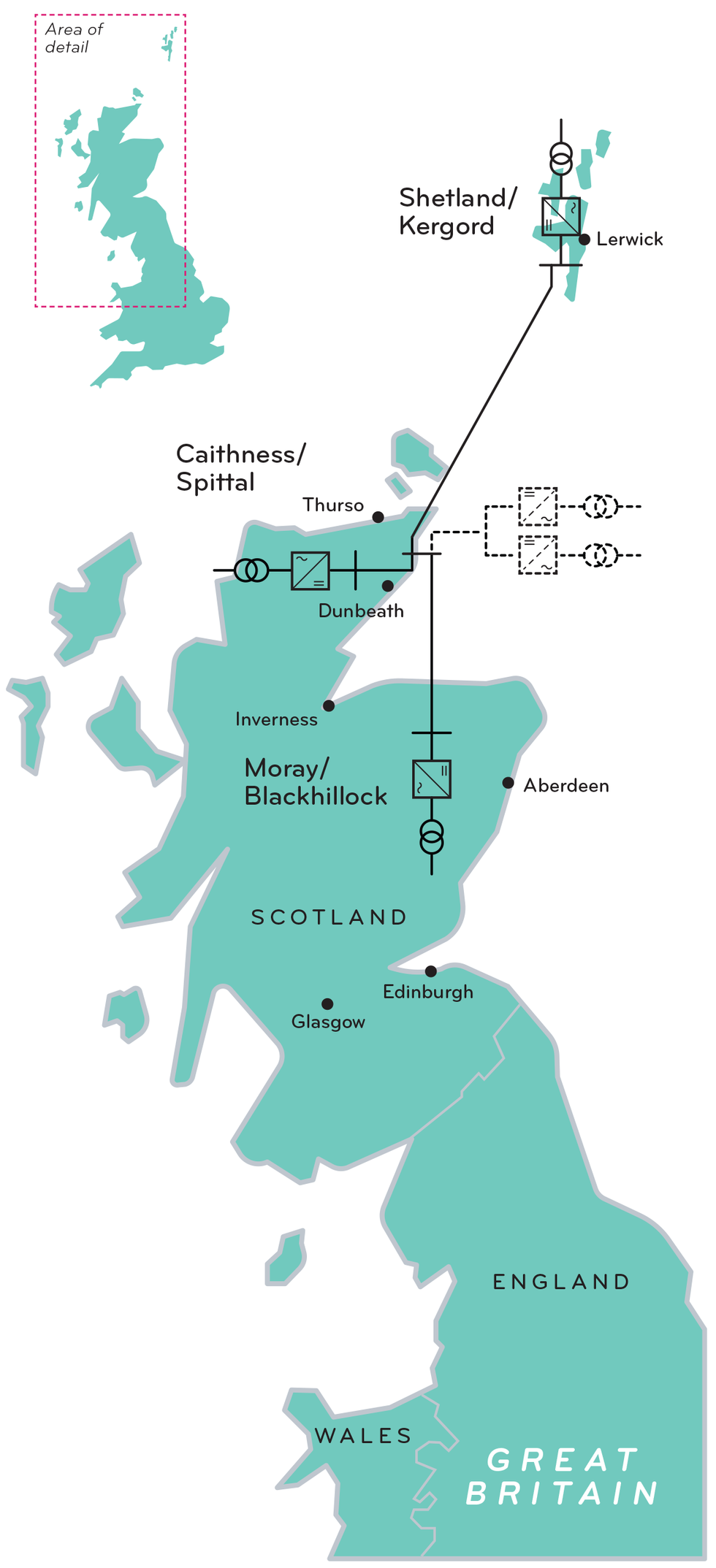

Power generated by the443-megawatt Viking wind farm, in the Shetland Islands, will feed a three terminal HVDC network, with the possibility of two more terminals in the future. The southern most terminal is at Blackhillock, Scotland, the site of Europe’s second-largest substation.Elias Stein

Power generated by the443-megawatt Viking wind farm, in the Shetland Islands, will feed a three terminal HVDC network, with the possibility of two more terminals in the future. The southern most terminal is at Blackhillock, Scotland, the site of Europe’s second-largest substation.Elias Stein

The key advance was the implementation of voltage-source converters (VSCs). Among other features, they allow operators of a transmission line to independently control not only the real power flowing on a line, but also the reactive power, which is the product of the voltage and the current that are out of phase with each other. Another feature of the new systems is modularity: Most modern VSCs are implemented as an integrated set of modules, in a system called a modular multilevel converter (MMC).

The converters are made up of submodules, and the higher the voltage being converted, the greater the number of submodules. These submodules, in turn, are typically based on capacitors and high-speed insulated-gate bipolar transistors. Energy from the AC source is stored in DC capacitors in the submodules. The capacitors are then charged and discharged in sequence to exchange energy with the AC network.

The Shetland link will create a three-terminal system by adding on to an existing HVDC cable further south. From the Shetland HVDC converter station, near the wind farm, DC is transmitted via the subsea cable to an existing converter station, near the cable’s landfall on Scotland’s northern tip. An inverter there can feed into the mainland AC grid. Or the DC power coming from the island can bypass that first mainland converter, continuing south to a third converter station that’s 160 km closer to Scotland’s big-city consumers. Or the system’s controller can flip the entire game plan, sending electricity north to Shetlands consumers just as quickly as its winds can shift.

What makes that dynamic power juggling possible is the flexible control over current and voltage that is the hallmark of VSC technology. Over the past three decades, China pushed traditional HVDC technology, based on current source converters and thyristors, to massive scale to send hydro, coal, and wind power thousands of kilometers to its coastal industries and megacities. To do so, engineers had to build the world’s most robust AC networks, including huge amounts of reactive-power compensation and a lot of filtering to prevent harmonic feedback.

VSC is a fundamentally different technology, pioneered in the late 1990s at Swiss-Swedish engineering giant ABB, whose power-grid business was recently acquired by Hitachi Energy. Unlike the traditional current-source converters, VSCs can regulate their own voltage. That means they can help stabilize the AC networks they trade power with. That feature gave ABB’s VSC-based systems an instant niche where there was literally no AC grid to lean on: sending electricity ashore from distant wind farms.

The technology caught a tailwind in 2010 when ABB’s leading HVDC rival, Siemens, commercialized the modular design that has since swept the market. Siemens’s MMC submodules switch only once per AC cycle, cutting losses from about 1.7 percent to 1 percent per converter. MMCs are now the standard configuration and are used in the United Kingdom’s newest offshore wind farm, off the coast of Yorkshire, which has 1,080 submodules and began delivering power in October.

European grid operators have deployed about 50 gigawatts of VSC-based HVDC technology to date. Another 130 GW is planned for the continent over the next 10 years, according to a September 2023 report that Plet cowrote for a U.S. grid research and advocacy consortium.

Europe and China Race for “Meshed” Grids

So far, Germany has the most ambitious program. A trio of HVDC systems will take wind power coming from offshore into northern Germany and move it inland to southern Germany. But far more HVDC transmission capacity will be needed to accommodate an anticipated surge in offshore wind. For example, Dutch-German grid operator TenneT recently signed €30 billion (US $33 billion) in contracts for 14 sets of converters and subsea cables to be operating by 2031—some in Germany and the rest in the Netherlands. That scale is cutting costs and speeding delivery by helping its vendors—GE Renewable Energy, Hitachi, and Siemens—finance capacity expansions.

Germany has also led standardization, with an eye to expanded DC grids down the line. TenneT asked all of its suppliers to offer compatible 525-kV HVDC systems with room for extra switchgear, creating the option to interconnect today’s segments in larger networks.

Other European states have joined the emerging 525-kV standard. The United Kingdom’s audacious network plan specifies a dozen 525-kV offshore wind links that its electricity system operator deems necessary by 2030. Among them is a possible five-terminal system linked end-to-end astride the North Sea coast—to minimize both the converter stations purchased and the cable crossings and landfalls dug across sensitive coastal ecosystems. In addition, the U.K. plans to push its growing wind harvest south toward London via six more offshore HVDC cables, running shore-to-shore like patch cords in an old-time telephone switchboard.

In 2020, Chinese utility giant State Grid started up the world’s first meshed DC grid—a four-node, 500-kV ring near Beijing

Ultimately, European grid planners foresee a day when today’s HVDC projects interconnect to form a meshed DC network stretching across the North Sea and beyond. That will require something extra: an HVDC circuit breaker capable of nearly instantaneous operation at 525 kV.

Cutting off AC power is more straightforward because its voltage zeroes out every time the current reverses direction. HVDC systems currently exploit that zero-crossing to handle faults, using AC breakers to power down the converters and thus squelch the continuous current flowing between them. But converter stops and restarts will be too disruptive to large HVDC networks. “When you go to four or five terminals, the system becomes too big to shut down,” says Andreas Berthou, Hitachi Energy’s group senior vice president and global head of HVDC.

In 2020, Chinese utility giant State Grid started up the world’s first meshed DC grid—a four-node, 500-kV ring near Beijing complete with 16 proprietary HVDC breakers. But Western sources say there’s been no independent assessment of its operation.

All of the big HVDC suppliers are working on circuit breakers. Hitachi Energy’s proprietary unit has been verified at 350 kV, and Berthou says it is being considered for “a couple” of offshore projects. “We are ready to tender at 525 kV,” he claims.

An HVDC converter hall at an undisclosed location is outfitted with Hitachi Energy’s Voltage Source Converter technology, based on modular, multilevel converters. Hitachi Energy

An HVDC converter hall at an undisclosed location is outfitted with Hitachi Energy’s Voltage Source Converter technology, based on modular, multilevel converters. Hitachi Energy

One of Germany’s cross-country HVDC projects will demonstrate an alternate approach: an MMC converter design with “full-bridge” modules capable of opposing and stopping gigawatts of DC power. The cost: twice as many pricey, power-consuming insulated-gate bipolar transistors per module.

Meshed HVDC grids seem like science fiction in a U.S. grid context—home to just 3 percent of modern HVDC installations, according to Plet’s report. But several states have plans to follow Europe’s HVDC lead. New Jersey selected a system of HVDC links to connect its first offshore wind farms, for example, and California is considering an offshore HVDC “patch cord” to boost its north-south power flows.

But securing the equipment won’t be easy, according to experts. Emmanuel Martin-Lauzer, a U.S. business-development director for Paris-based cable manufacturer Nexans, recently likened Europe’s project pipeline to a “black hole” devouring the world’s supply of HVDC cable.

Plet says some U.S. transmission developers have put down “tens of millions of dollars” to secure a place in production queues—a “big risk” since poorly coordinated state and federal grid-approval processes kill off many projects. Developers will also pay dearly to staff up, he says, given the dearth of U.S. electrical engineers with HVDC expertise. Adding it up, Plet figures that U.S. HVDC development may lag Europe’s by a decade.

This article appears in the January 2024 print issue as “High-Voltage DC Power Roars Ashore in Europe.”

Reference: https://ift.tt/XiAaOTN

No comments:

Post a Comment